“You should make a budget.”

If you’re like me, you’ve heard this dozens of times. And each time, it has elicited eye rolls, anxiety attacks, and just plain frustration. Sure, making a budget seems like a really simple exercise. But, for some reason of human psychology, it is always hardest to make a budget at the very moment that you most need to: when you’re facing a financial hurdle. In this series of posts, I’m going to give you some basic strategies that will make budgeting easier and way less scary.

So you think you know where your money is going?

While today’s technology has made budgeting easier and more automated than ever, it’s also a bit of a trap. I mean, it used to be that you were forced to write down every payment that you made in your checkbook to balance it. Now, you just look at your bank account occasionally (even though sometimes it’s terrifying). So, you tell yourself, I don’t really have to write out a budget. I see where my money is going already; my problem is not having enough money.

I’ve definitely fallen into that thinking before. In fact, I would bet the majority of people facing some financial challenge, whether it is loan debt, credit card debt, not enough income, or even saving for a car, a house, or an emergency, don’t actually sit down and write out a budget because of how tempting it is to just say, “I already know where my money goes because I look at my bank account a few times a month.”

Prove it.

That’s what got me to start budgeting. I said, “Ok, I think I know where my money is going. Now I’m going to prove it to myself.” And you know what? I was wrong. I did not know where all of my money was going. And I’ll bet you don’t either, unless you’ve really examined every dollar in a given month of your finances.

Right now, today, go write down where your money went for the last 30 days

A lot of people make the mistake of thinking that they need to wait until the 1st of the month to start analyze their spending. That’s absurd. A month is an arbitrary timeframe; it’s just 28-31 days. Start today. Seriously. Today. What if I told you that every day you wait, you literally lose money? Would you do it today? Then do it today!

Step 1: Write Everything Down

Grab a piece of paper. Go to your bank account(s), your credit card account(s), your student loan account(s), your retirement account(s), and any other place where your money goes into or comes out of. Start 30 days ago and write down absolutely everything.

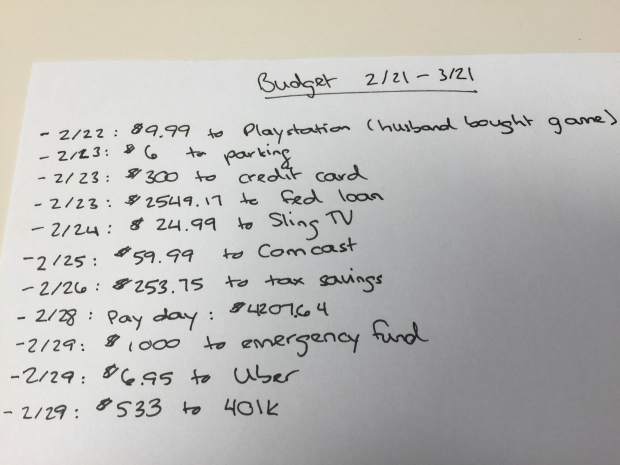

Here’s my example from the end of February 2016:

My handwriting is atrocious. Sorry.

Grab Some Highlighters

Ok, you’ve got your big list. Now grab 4 highlighters, sharpies, colored pens/pencils, crayons, post its, or whatever colored thing you have to distinguish 4 categories.

Color Code Into 4 Simple Categories

| Fixed Expenses | Expenses that don’t change. Rent, mortgage payments, minimum student loan payments, monthly gym membership, subscription services like Netflix or Birchbox, etc. |

| Flexible Expenses | Stuff you pay every month, but the amount varies. Grocery costs, utility bills, any payments you make on top of minimum debt payments, restaurants/bars, any other purchases (clothing, gifts, home goods, etc) |

| Savings | Money that you contributed to an emergency fund, to a project savings account (like saving for a house, car, vacation, big purchase). If it went into a savings account, it’s savings. |

| Investments | 401k contributions, IRA contributions, any other investments. Include your pre-tax contributions here too, so check your paystub. |

That’s where the money goes

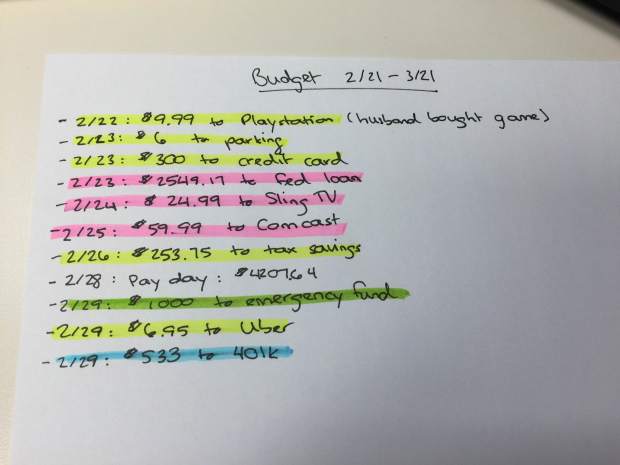

Here’s my result:

Pink = Fixed; Yellow = Flexible; Green = savings; Blue = investment

I’m going to guess that the majority of your list got highlighted as a flexible expense. You can see that’s definitely the case for my little snapshot.

This is why budgeting is really hard! Most of your day to day spending is on flexible costs, rather than the fixed costs or money you put toward your future (savings/investment). That’s why it’s such a good exercise to actually write down and color code where the money goes.

What’s next? We know where the money actually goes. Next time, we will figure out where it should go.