“Millennials.”

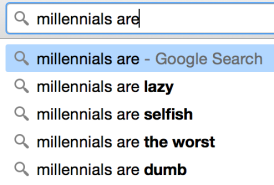

It’s almost a dirty word now. I’m not sure whether any previous generational name tag has garnered as much contempt as ours. But somewhere, the fact that I have posed that question has caused a member of another generation to roll his eyes, and mutter, “Millennials.”

In many ways, the Millennial generation is very much like previous generations. To the extent that you can generalize, as young people, we are more progressive than conservative. As were our parents and grandparents when they were young. We have seen times of economic boom, and economic bust, like our parents and grandparents did. We have watched our country struggle with the issues of racism, gender divides, immigration, abortion, politicians who don’t respond to their constituents. We still want the American dream, as did our parents and grandparents.

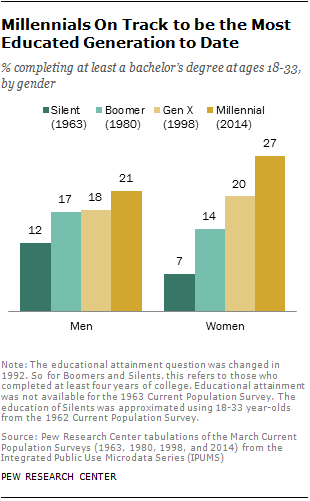

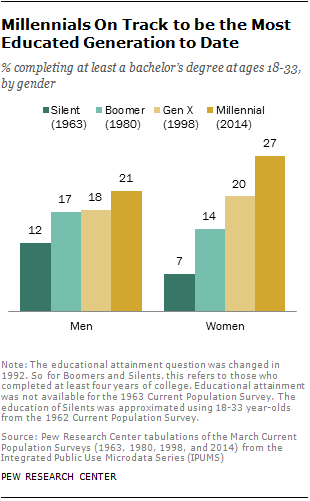

But, to say that there is nothing unique about the Millennial generation is to bury your head in the sand. According to the Pew Research Center, we are better educated.

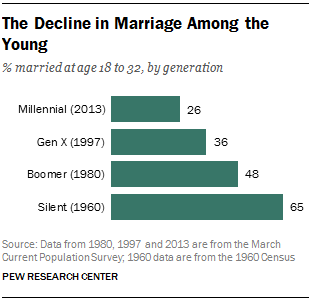

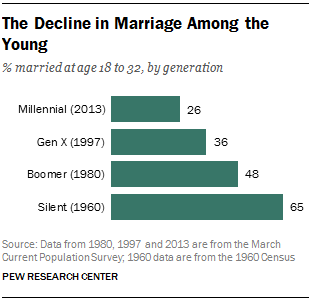

We are waiting longer to get married.

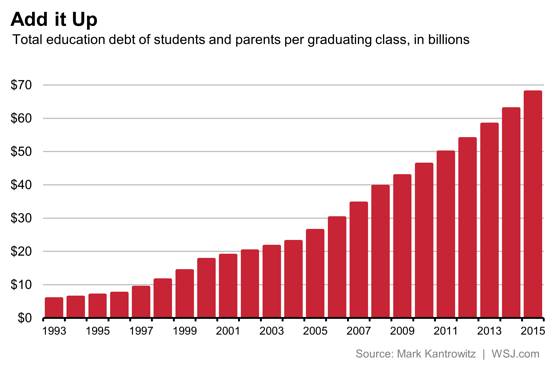

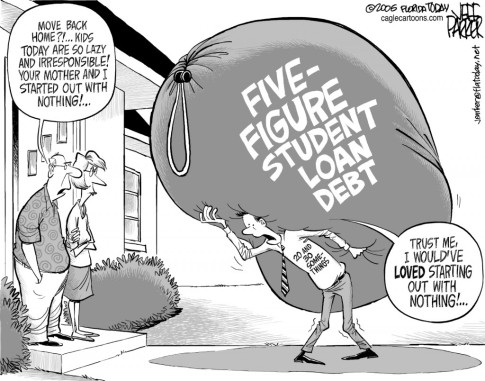

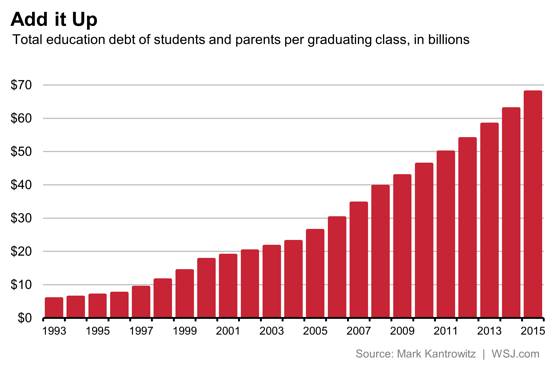

But, perhaps the most important distinction, we have a lot more student loan debt.

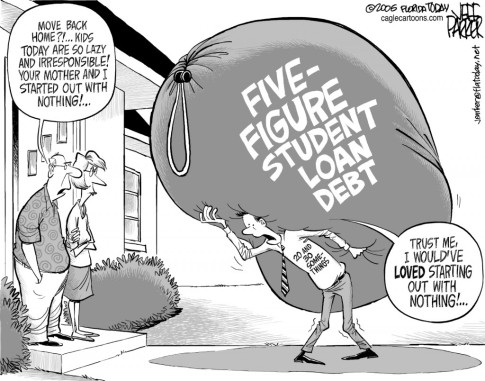

This has lead to a lot of hostility between the generations.

(and I would have loved to start out with just five figures)

This hostility makes having a dialogue about student loan debt and the challenges that millennials face difficult. That conversation, an essential one for the economic vitality of our nation, is not one for this blog. I am not an economist, a finance wizard, or a policy maker.

I wanted to present the above statistics and the reality of the dialogue to set the stage. This blog will focus on my husband and my efforts to repay our substantial student loan debt. I want to talk with readers about budgeting, saving, refinancing, the federal repayment programs, whether to even take out a student loan in the first place. I want to give readers a picture of what living under six figure debt looks like. This post, I wanted to give a glimpse of the big picture. Next post, I will give a glimpse of the small picture. Who my husband and I are, where do we work, and just how much debt we are tackling.

You looked at Part 1 and you wrote down where your money went for the last 30 days. Next step is simple: figure out where it should have gone. Figuring out where your money should go is the key step that most people miss when they are trying to pay down debt or start savings. Keep reading to figure out how to figure out this missing piece the budgeting puzzle!

You looked at Part 1 and you wrote down where your money went for the last 30 days. Next step is simple: figure out where it should have gone. Figuring out where your money should go is the key step that most people miss when they are trying to pay down debt or start savings. Keep reading to figure out how to figure out this missing piece the budgeting puzzle!

Last post, I wanted to discuss the “big picture” of my generation and our student loan debts. But that will not be the main focus of this blog. The main focus of this blog is going to be on my journey to repay my student loans, and I will also touch on my husband’s journey to repay his. Click through to see who we are, what we do, and just how much I owe.

Last post, I wanted to discuss the “big picture” of my generation and our student loan debts. But that will not be the main focus of this blog. The main focus of this blog is going to be on my journey to repay my student loans, and I will also touch on my husband’s journey to repay his. Click through to see who we are, what we do, and just how much I owe.