You looked at Part 1 and you wrote down where your money went for the last 30 days. Next step is simple: figure out where it should have gone. Figuring out where your money should go is the key step that most people miss when they are trying to pay down debt or start savings. Keep reading to figure out how to figure out this missing piece the budgeting puzzle!

You looked at Part 1 and you wrote down where your money went for the last 30 days. Next step is simple: figure out where it should have gone. Figuring out where your money should go is the key step that most people miss when they are trying to pay down debt or start savings. Keep reading to figure out how to figure out this missing piece the budgeting puzzle!

Luckily, all that highlighting we did is about to pay off! That color that you used for fixed expenses? Guess what? The money that went to fixed expenses should have gone to fixed expenses.

What about flexible expenses? This is where your individual budget magic happens.

Let’s say you spent $125 on eating out, $25 on coffee runs, $59 on a new video game, and $460 on groceries. These flexible expenses total $679.

You may very well have $679 of wiggle-room in your budget. So, you might think, what difference does it make how that money gets spent? As long as I have the money, it makes no difference where it went.

But here’s the trick. Under my budgeting system, and money that isn’t a fixed or flexible expense within the budget doesn’t just get to be extra flexible money. The extra money goes into savings/retirement or is applied on top of minimum fixed payments on my debt (aka student loans).

So, it’s worthwhile to actually set up limits for yourself on where your flexible money goes. $460 on groceries when you also spent $125 eating out and $25 on coffee would be too much on food in a month for my life circumstances (2 adults). But it would be a solid budget for someone with 3 kids! That’s why I can’t tell you how much to spend down to the dollar. You need to sit down and think about where the money should go.

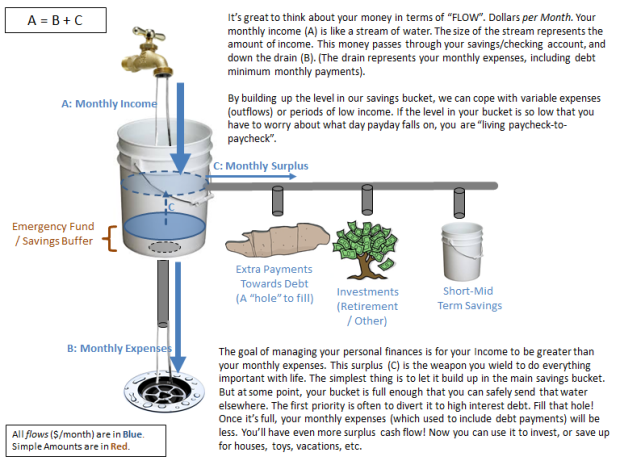

This graphic helps explain the thinking. The money that you can cut out of the flexible and fixed expenses categories is less money going down the train. That means you can move that money into other places, like savings and retirement.

There are tools to help you figure out what your own personal limits for your flexible expenses should be. You’ve probably heard of Mint.com. And with good reason. It is a really good free tool that I personally use. You Need a Budget is similar software, though it’s not totally free (they do a free trial and discounted rates for students though!). One that you may not have heard of is Personal Capital. It is free and focuses on automation.

There are also a lot of free excel spreadsheets out there. Here’s one. Here is another. Whatever tool you use, figure out where the money, and think about where it should go. Remember that the more you can cut out of expenses, the more you can save. It’s that simple. Spend less, save more.

So, how do you go about doing the cutting? You need to set some goals. Your goals should follow the SMART mantra:

- Specific – Ensure you are stating specific goals. Example: “I will cut my restaurant budget by 25% this month.”

- Measurable – You need to have a way to measure if you succeeded or failed. With money, this is usually pretty easy. The example above is measurable; if you spent $100 on restaurants this month, you’ve succeeded if you spend $75 or less next month.

- Assignable – Usually this is assigned to you, but can be for anyone (especially if you have a family). “My spouse will maximize contributions to an IRA this year.”

- Realistic – Cutting your restaurant budget by 100% probably isn’t achievable in one month. Gradually changing a bad habit is the best way to achieve long-term success.

- Time-bound – Hold yourself accountable by setting a deadline. Goals with nebulous time frames you can adjust at will don’t help you.

Where are some common places to cut out expenses? Coffee runs are huge. At $25/month for coffee runs, you spend $300/year on coffee. $25 is probably a low estimate if you’re a big coffee drinker. But for $300, you could buy an Aero press and make your own gourmet coffee at home. For $90, you could buy your own cappuccino/espresso maker. Or if you’re a latte addict, buy your own latte maker for less than $80. Frappuccinos your drug of choice? Ta-da, less than $60! There is no excuse not to cut down on a coffee budget.

Eating out is another big area. My husband and I would go crazy if we didn’t eat out once a week. It’s something we look forward to immensely over the course of the week. But, we don’t eat out other than that time. Bringing your lunch to work is an effective way to save hundreds per year. Funnel that money to retirement savings and it becomes thousands over your lifetime. Funnel it to loans and it’s an automatic return on your money.

Next time, I will talk about how to budget when you have student loan debt, because that makes this a little bit harder.