Hello again! Today I’m going to be sharing my absolute must have tool for figuring out student loan debt repayment. I didn’t create it. Some of the really wonderful people on Reddit did, actually. But, it is absolutely invaluable and it’s completely free, no sign up required, etc. I’m not affiliated with it in any way. Just a die hard fan. Read on to see what it is and how I use it.

It’s called Unbury.us. It used to be called Unbury Me but the site went down and a kind Reddit user rebuilt it. So, go ahead and open the site up in another tab, and let’s get to work.

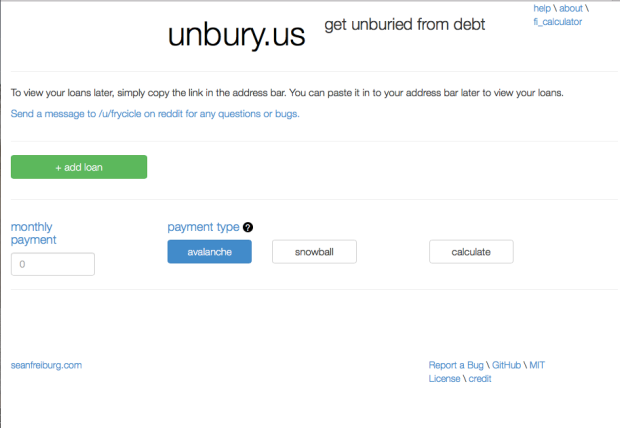

The first thing that I love about this site is how simple it is. There is nothing overwhelming here. You just have to click the green “+add loan” button to get started. So go ahead and click that green button.

Simplicity defined

When you click the green button, some boxes appear. Give your loan a name. I’m going to be entering my Fed Loan loans. So I log into my Fed Loan account and my first loan is an Unsubsidized Direct Stafford Loan from August 2014. Ok, I enter “8/14 DSL.” The current balance on that one is $21,291.98. On Fed Loan, you can actually see a breakdown of what your minimum payment per loan is when you click the “View Loan Details” button and select “View Details” on each loan. So, from the details on this loan, I see that my minimum payment is $246.28. And finally, the interest rate is 5.96%.

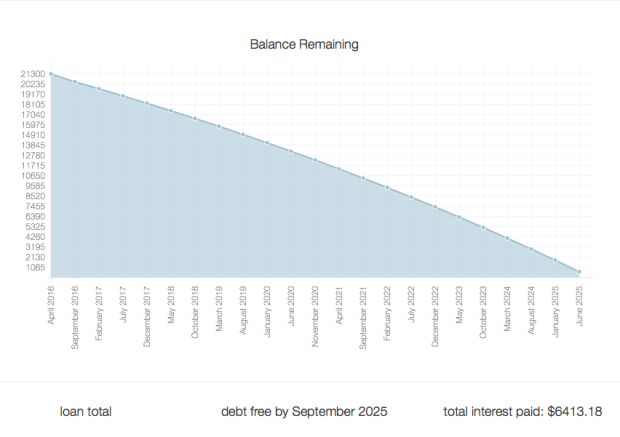

And like magic, when you finish entering in those things, Unbury generates some handy information.

So, as you can see, Unbury tells you when your loan will gone, and when it is gone, I will have paid $6413.18 in interest.

What I love about Unbury is how quickly this data adjusts when you change variables. Let’s play around, keeping it simple with just this one loan for now.

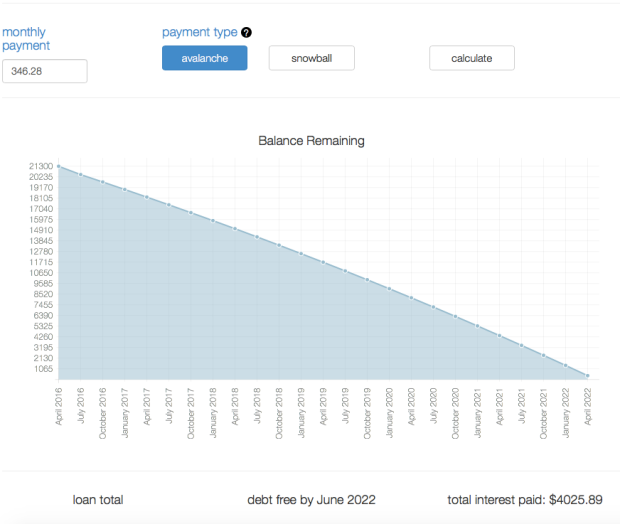

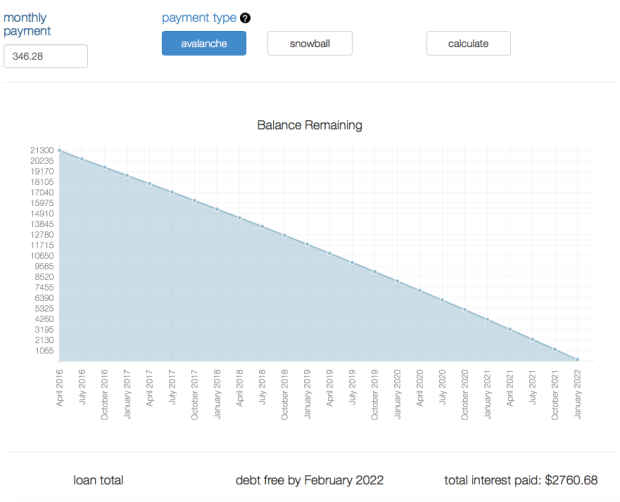

Let’s say after reading my 3 part series on budgeting, you’ve found another $100 that you can throw onto your loan. How will that impact things? I just change the monthly payment box to $346.28.

With an extra $100 on top of minimum payment

So, now you see the power of little changes. With this extra $100 a month, I will kill this loan over THREE YEARS early and save $2387.29 in interest. Just from that little bit of effort cut $100 from somewhere (eating out in an expensive city twice a month, perhaps!).

Alright, so what else can we learn here? Let’s say I’m contemplating getting this loan refinanced with a lender like SoFi. SoFi tells me they will get the rate down to 4.375%. How does that change the picture (assuming I’m still paying $100 over the minimum and the minimum hasn’t changed).

With a refinance to 4.375%

I’m out of debt 4 months earlier, paying a whopping $1265.21 less in interest.

As you can see, Unbury excels at showing you the power of small changes. One refinance and an extra hundred bucks, and you have managed to get out of debt over 3 years earlier at a savings of $3652.50.

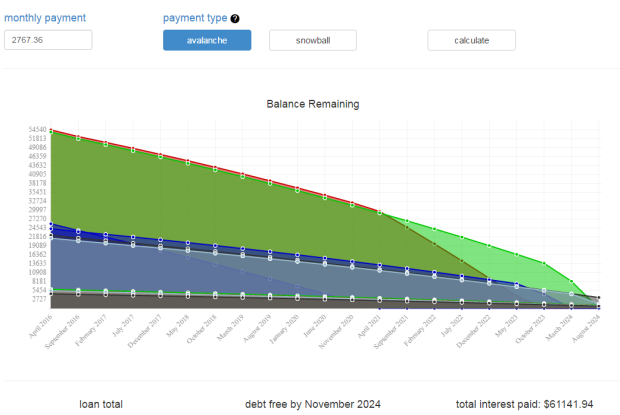

But, we’ve only just begun. Here is where Unbury really shines. You can enter all your loans in, and explore every possible path to repayment that you can think of, and it will adjust your payoff date and your interest paid effortlessly every time. Let’s take a look at my full loan profile right now:

Multiple loans

You may also have noticed the buttons labeled “Avalanche” and “Snowball” under Payment Type. What do they do? I’m going to talk more about these in a separate post, but for now, simple definitions will do.

An avalanche payment approach puts any extra payments you make completely on the highest interest loan. Then, when that loan is paid off, you move all the extra payments plus the amount you were paying toward the highest interest loan onto the second highest interest loan. In this way, you’re creating an “avalanche” from the top of your loans, so to speak, by always working on the highest interest loan that you have left. This is mathematically the repayment structure that saves the most on interest payments over the lives of the loans (more on this in another post).

A snowball approach puts all extra payments toward the lowest balance loan. When that loan is paid off, you would move the extra payments and the money you were paying on the smallest balance loan to the next highest balance. In this way, you are building a repayment snowball that builds and builds as you kill smaller loans. I will talk about some reasons why you might opt for this strategy, even if it isn’t the most mathematically optimal, in another post.

So, toggling those two buttons will show you the difference in the interest that you pay and the payoff time.

I will be talking much more about how I use this tool to plan out my repayment in future posts. For now, I wanted to introduce you to the features. Let me know if you try it out what you think of it in the comments below!